The process of GST Cancellation is governed by Sec-29 of CGST Act, 2017. You need to note the following essentials before you apply for the revocation of cancellation of GST registration:

- You can process the application for revocation of cancelled registration both online and offline.

- You can process an application, only if you are a previously registered taxpayer.

- You are able to revoke your GST registration only if your GST registration certificate has been cancelled by GST authorities, not if it has been cancelled voluntarily by you.

- You can apply for re-activation of your GST number only within 30 days from the date of service of order or cancellation of GST registration.

- You cannot apply if the registration has been cancelled due to failure to furnish returns and pay due taxes.

- Upon submitting your application for revocation of cancellation, it may or may not be accepted by GST officials, depending upon the reasons and grounds for revocation.

- Following applicants are considered ineligible for revocation of cancelled registration: UIN Holders (i.e. UN Bodies, Embassies and Other Notified Persons); a GST Practitioner; and if the registration is cancelled on request by the taxpayer or by the legal heir of the taxpayer, they ultimately become ineligible for revocation of cancelled registration.

Contents

What is the Online Application Procedure to Revoke a Cancelled GST Number?

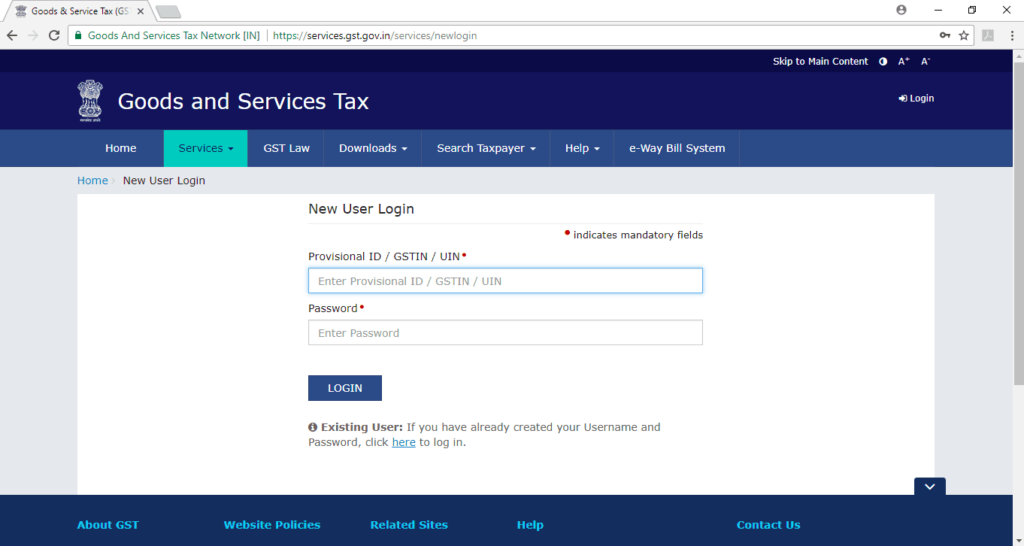

Step 1: Visit the GST Portal for the Revocation of Cancellation of GST Registration.

Step 2: Log in to your account by entering the correct username and password, and the captcha text.

Step 3: Select Services>> Registration>> Application for Revocation of Cancellation, on the Homepage.

Step 4: Enter the reason, in the tab for ‘Reason for revocation of cancellation field’.

Step 5: Select ‘Choose File’ to attach supporting documents.

Step 6: Select the verification checkbox and select the name of authorized signatory from the drop-down list.

Step 7: Enter the name of the place from where the application is filed in the ‘Place Field’.

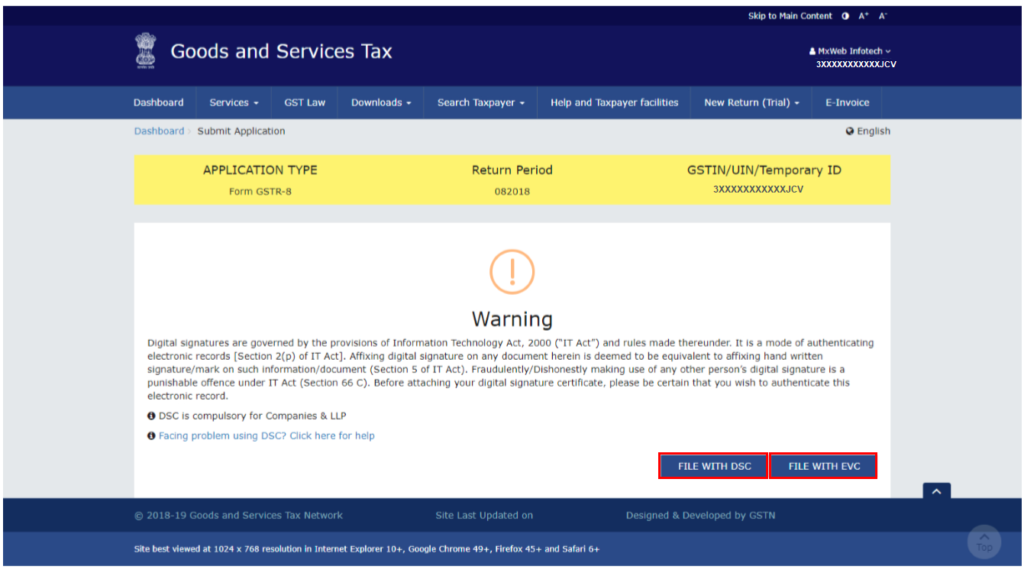

Step 8: Submit with DSC or Submit with EVC.

Step 9: Sign the application either with your Digital Signature Certificate (DSC) or the EVC option. You will receive an OTP, upon selecting either of the options.

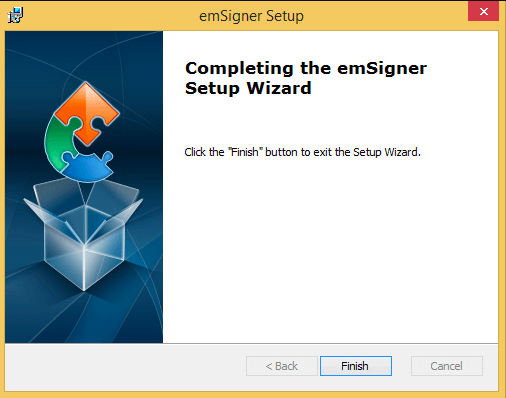

Step 9.1: If you use a DSC, you should select the registered DSC from the emSigner for GST pop-up screen and proceed from there.

Step 9.2: If you use the EVC Option, enter the OTP, and click on the ‘Validate OTP’ button.

Step 10: If you have successfully filed the application, the system will generate the ARN and display a confirmation message.

Step 11: You will also receive a confirmation message on your registered mobile phone number and email ID from the GST Portal.

Upon Acceptance of the Application

- You will receive an approval order, and a notification from the system, Primary Authorized Signatory through email and SMS.

- Your GSTIN Status will change from Inactive to Active status with effect from the effective date of cancellation.

Upon Rejection of the Application

- A rejection order is generated if your application for revocation of cancelled registration is rejected by the GST officials.

- The GSTIN status remains “Inactive” on the GST Portal, and you will receive the Primary Authorized Signatory through email and SMS, stating the rejection of the application.

- You can view the Rejection Order Receipt on your dashboard.

You can also apply offline to reactivate your cancelled GST registration by filing Form GST REG-21. The form can be downloaded from the GST portal. You can also seek help at GST facilitation centers notified by the Commissioner.

Read More:- 8 Things You Need To Check Before Using An Accounting Software

What is the Offline Application Procedure to Revoke a Cancelled GST Number?

- You can submit your application of the revocation of cancellation of GST Registration with Form GST REG-21 only if it has been cancelled suo moto by GST officials.

- You must submit the application within 30 days from the date of cancellation.

- Your application is approved by the GST officials in Form GST REG-22.

- Your application may also be rejected by the GST officials. Before issuing the order of rejection, the cause of the rejection is issued by GST officials in Form GST REG-23.

- You are expected to provide a suitable reply in Form GST REG-24 within seven working days from the date of the notice.